Do I really need travel insurance?

Travelling in the post-pandemic world can be extremely daunting, especially when you know that there are many things that can go wrong while you're far away from home.

Whether it's for the peace of mind or to ensure you don't end up with a hefty price tag if unwanted accidents occur, travel insurance has become an increasingly important travel essential for those looking to explore the world again.

Many people have limited knowledge about it though, with burning questions from where to buy travel insurance to how much it costs. If you're a clueless soul scrambling to find out more about travel insurance, fret not, you've landed on the right page! Find the answers to all your questions about travel insurance below.

Answering all your burning questions about travel insurance

1. Which countries require travel insurance?

Many countries have established a mandatory travel insurance requirement to facilitate safe and hassle-free travels. If you're travelling to these countries, you'll need to purchase specific travel insurance that provides medical coverage including costs of COVID-19 treatment, hospitalization, and more.

As of the time of writing, these countries have a mandatory travel insurance requirement in place (do note that if you don't have one, you will likely be denied entry or even disallowed from flying at the airport of departure!):

- The Philippines (medical coverage of at least $35,000)

- Turkey

- UAE

- Morocco

- Cuba

- Ecuador

- Iran

- Togo

- Algeria

- Romania

- Croatia

- Moldova

- Georgia

- Aruba

- Lebanon

- Seychelles

- Antarctica

- Schengen countries

Disclaimer: travel restrictions change all the time - double-check the travel guidelines on official sites for the latest information.

If the country I'm travelling to does not require travel insurance, should I still get it?

"Travel insurance many not be mandatory, but it's always a good idea."

Although many countries have eased their travel restrictions and removed requirements to have travel insurance, we 100% recommend still getting yourself an insurance plan just in case. ✨

Here are some reasons why you should get yourself travel insurance before you fly:

- Medical costs overseas can be really expensive: depending on the country you're travelling to, medical costs can come with a very hefty price tag and can cause a lot of stress (which is really not ideal when you're in a foreign country!). We are firm believers that the small cost of getting a simple and affordable insurance plan definitely greatly outweighs the potential high costs of a medical emergency overseas.

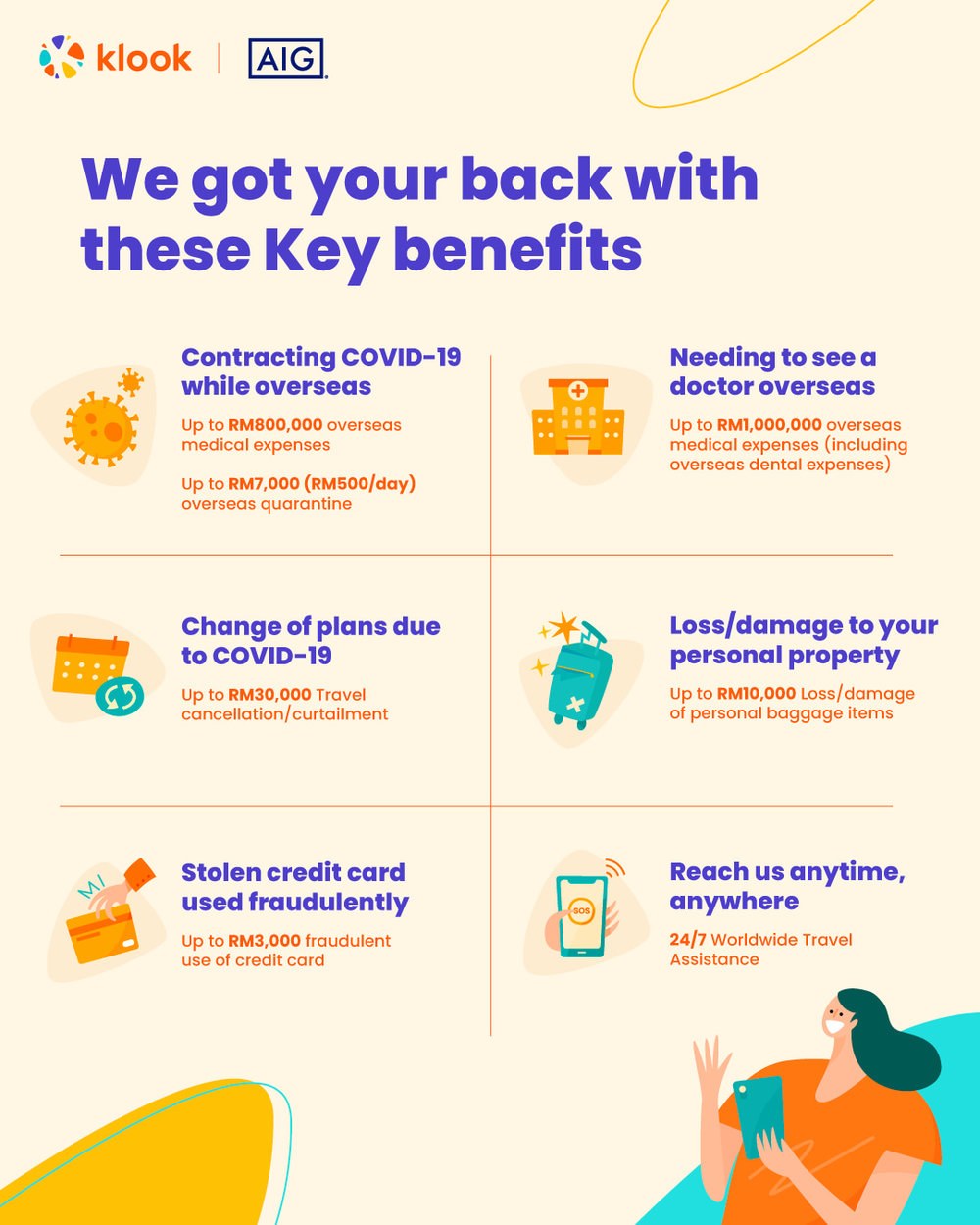

- Travel insurance covers more than just medical costs: besides medical-related coverage, most travel insurance plans also cover a wide variety of other travel-related risks, from travel delay to trip cancellation, fraudulent use of credit card, baggage delay, and more. Even things like missing a flight connection and losing your baggage are typically covered under a comprehensive travel insurance plan!

- It's not expensive or complicated to get one: contrary to popular belief that insurance is expensive and lots of hassle to purchase, it's no longer the case now that you can easily book yours in just a few clicks on Klook. 📱

Where can I buy travel insurance with COVID-19 coverage in Malaysia?

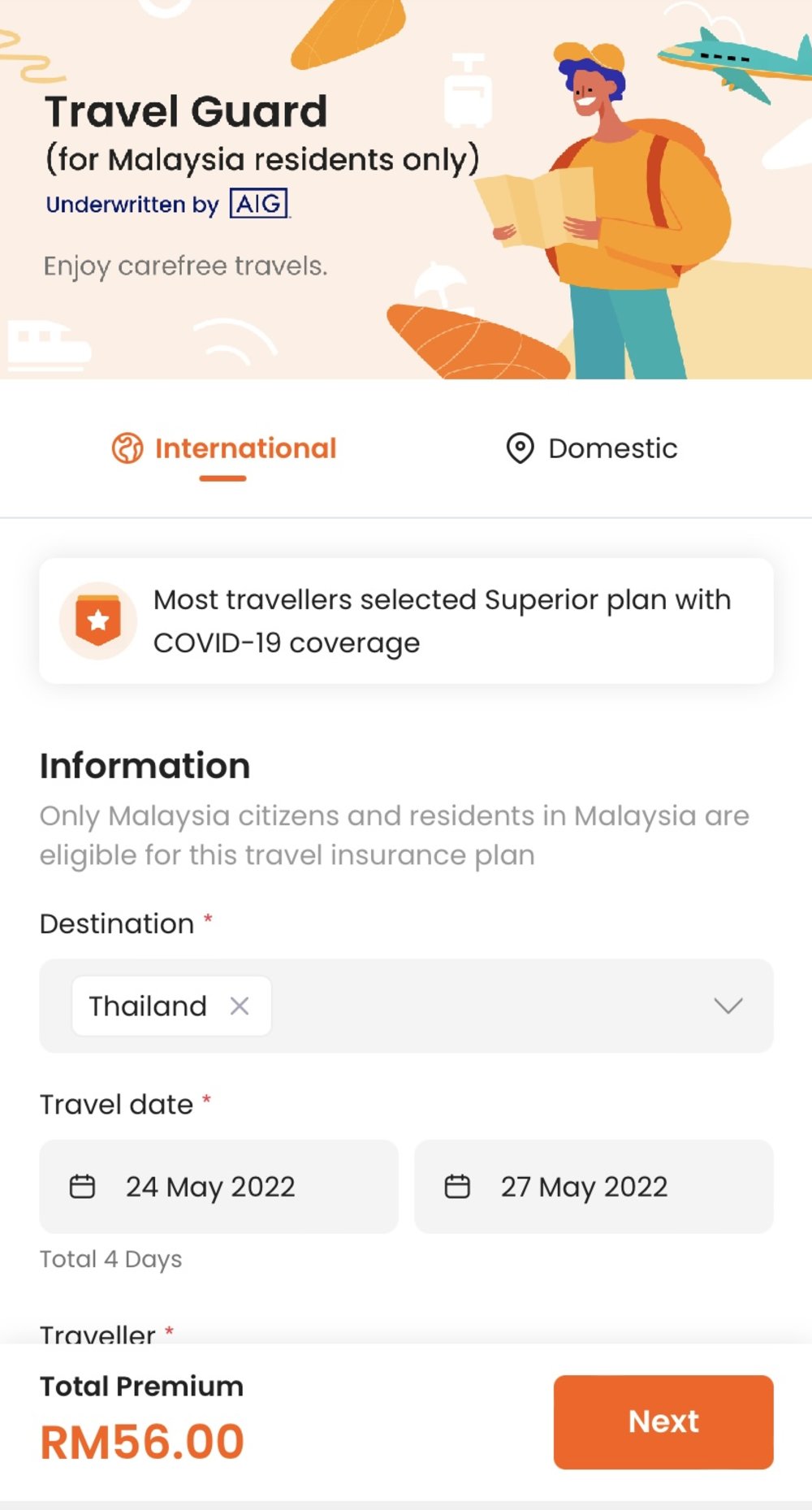

Most insurance companies offer travel insurance plans, and we've partnered up with AIG Malaysia to allow you to purchase yours on Klook in a few clicks! So no, you don't have to make calls, go through information-overloaded websites, or meet an agent to purchase your travel insurance plan anymore.

How much does travel insurance cost?

How much your travel insurance is going to cost depends on where you're travelling to as well as the duration of your trip. We also have three different types of insurance plans on Klook (Essential, Superior, and Premier) with different levels of coverage.

For a plan that covers COVID-related costs and meets all mandatory insurance requirements, we'd recommend getting a Superior plan that can be purchased from as low as RM56 per trip!

The Klook x AIG Superior travel insurance plan provides coverage for:

- Medical expenses incurred overseas (covers COVID-19): RM600,000

- Out of country COVID-19 diagnosis quarantine: RM300/day

- Travel cancellation & postponement: RM25,000

- Travel curtailment: RM25,000

- Emergency medical evacuation & repatriation: unlimited

- Compassionate visit: RM12,000

- Child guard: RM12,000

- Daily hospitalisation income: RM250/day

- Emergency phone charges & internet use: RM300

- Follow up medical treatment in Malaysia: RM50,000

- Loss of personal baggage items: RM7,000

- Baggage delay: RM1,000

- Fraudulent use of credit card: RM2,000

- Loss of travel documents: RM6,000

- Accidental death & permanent disablement: RM400,000

- Car rental excess charges: RM3,000

and more!

When do I need to get my travel insurance?

You can book your travel insurance any time before the date of your trip, but we recommend buying it as soon as you begin your trip planning and have made your flight bookings. The earlier you purchase your plan, the earlier you're protected against unforeseen circumstances, so don't wait till the last minute. ✨

How do I book my travel insurance on Klook?

Buying your travel insurance on Klook is as easy as 1, 2, 3!

Simple steps to book your travel insurance:

- Download the Klook app & log in to your account

- Click on the 'insurance' icon on the app homepage (or access page here)

- Fill up your travel information (e.g: destination & travel date)

- Select your choice of plan depending on how much coverage you require or your budget (we recommend the Superior plan for adequate COVID-19 coverage ✨)

- Make payment

All set for your trip?

Get the rest of your travel essentials on Klook for a safe and hassle-free adventure. From hotels to car rental, discounted attraction tickets, unique local experiences, day tours, and more, we've got you covered from A to Z.

[✨Promo Alert✨] Planning your first trip overseas since the pandemic? Use code <TRAVELTHEWORLD5> for 5% off all activities on Klook, applicable for all destinations across the globe! If you're a MasterCard credit cardholder, you can also use code <MC12OFFMY> for 12% off.